‘Tis the Tax-Intelligent Season of Giving: Charitable Bunching and DAFs

Amanda Young, CFP®

Financial Planning Analyst

With holiday decorations already adorning retailers’ shelves, it’s time to begin thinking about the season of giving. If you’re working with a tax-intelligent Financial Professional, you’re likely aware that tax intelligence isn’t relegated to just one season. However, end of year is an especially important time to strategize how to be tax efficient in your charitable giving.

If you answer “yes” (or even “maybe”) to any of the following questions, you’ll want to read on:

- Do I currently donate to charity but don’t exceed the standard deduction each year?

- Do I have charitable contributions listed on my tax return but I’m still taking the standard deduction?

- Will I be in a higher tax bracket next year and want to reduce my taxable income?

Charitable Bunching in a Nutshell

Charitable bunching is a simple concept that rose in popularity after the Tax Cuts and Jobs Act passed, which roughly doubled the standard deduction through 2025, thus making it difficult for certain households to qualify for many common individual tax deductions (including – you guessed it – charitable donations).

With a little bit of planning (and a tax-intelligent Financial Professional by your side, of course) you can take advantage of charitable bunching to help save on taxes. Instead of defaulting to the standard deduction, charitable bunching allows you to group your charitable contributions for multiple years together into one tax year using a donor-advised fund (DAF) (more on that below). This strategy may allow you to surpass the standard deduction threshold in the year you decide to donate these funds, allowing you to take advantage of itemized deductions.

That brings us to DAFs and why they go hand-in-hand with charitable bunching. One of the most tax-intelligent ways to bunch your charitable contributions and help ensure tax savings in the years to come is through utilizing a DAF. This account type allows you to:

- Invest money tax-free

- Potentially earn gains on those funds

- Contribute money at any time

- Conveniently make donations to charity whenever desired

Case Studies

So, what does this look like in practice? Here are two hypothetical scenarios to help put this tax-intelligent strategy into focus.

Marissa, who files single with no dependents, will have $5,500 in itemized deductions in 2024 and has donated $8,000 to charity. Let’s say she will also have $5,500 in itemized deductions and plans to donate another $8,000 to charity in 2025. Marissa can choose one of two options:

Option 1: Since her total deduction amount will be below the standard deduction for 2024 & 2025, she can plan to take the standard deduction for each of those years, which amounts to $29,600 in standard deductions.

Option 2: Marissa and her tax-intelligent Financial Professional decide to “bunch” her charitable donations into one year. The first year, she takes $5,500 in itemized deductions and donates $16,000 (two years’ worth of planned gifting) to her DAF. The second year, she takes the standard deduction of $15,000. This totals $36,500 in deductions.

In other words, if Marissa is guided by her tax-intelligent Financial Professional to take advantage of option 2, this could equal $6,900 of additional tax deductions for her over two years!

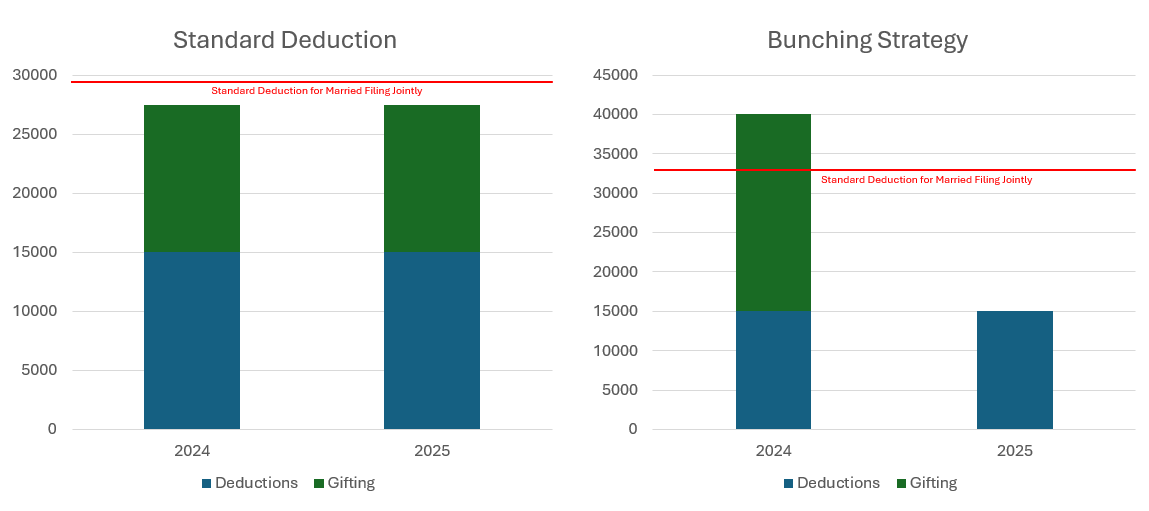

Jack, who is married filing jointly, has $15,000 in deductions and an additional $12,500 in charitable giving in 2024. As illustrated in the graphs below, bunching two years into one allowed Jack to take advantage of itemizing when he otherwise would have taken the standard deduction.

For Jack, this could mean $10,800 of additional tax deductions over two years!

Considerations

As with any financial planning strategy, it’s important to fully understand the potential benefits and drawbacks of charitable bunching and DAFs to help avoid any unwanted surprises. For example, you won’t receive a deduction every time you send grants/donations from your DAF to your chosen charities when utilizing a charitable bunching strategy. Instead, you’ll be receiving the deduction on the total amount deposited into the DAF for that year.

Additionally, since DAF contributions don’t have to be disbursed immediately, you may need to get used to the new process of distributing funds from your DAF to your chosen charities. Consider implementing reminders or processes to help you remember to continue making the desired contributions to the causes you care about most.

DAFs can also be subject to administrative and investment management fees, depending on the sponsoring organization.

Charitable bunching may not be a suitable strategy for everyone. Be sure to consult your Financial Professional to see if DAFs and charitable bunching would be beneficial for your situation.

*Source: The Ultimate List Of Charitable Giving Statistics For 2024

Although Avantax Wealth Management® does not provide tax or legal advice, or supervise tax, accounting or legal services, Avantax representatives may offer these services through their independent outside business.