Market Recap – Week Ending Sept. 20

Markets Rally Following Fed Rate Cut

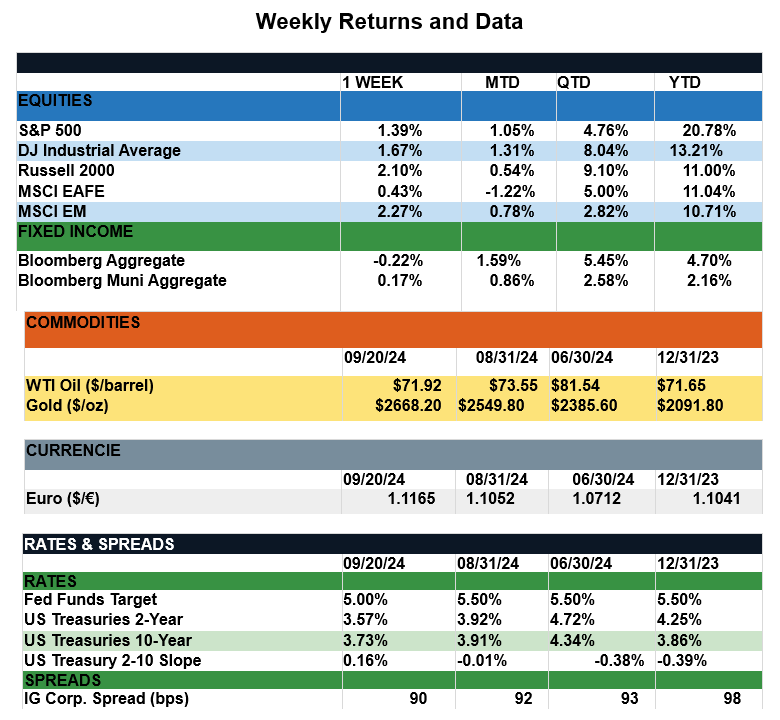

Overview: Stocks across the globe were higher last week on the heels of the highly anticipated Federal Reserve rate cut. The Fed lowered rates by 50 basis points (0.50%) to a range of 4.75% -5.00%. This was the first rate cut in four years after the Fed had held the funds rate steady at a range a 5.25% - 5.50% for the past 13 months. Markets rallied on the news with the S&P 500 index recording its 39th all-time high of the year on Thursday, finishing the week 1.4% higher. International stocks followed suit, with emerging markets (MSCI EM) up 2.4%, and international developed stocks (MSCI EAFE) higher by 0.4% on the week. In bonds, yields were largely unchanged, with the 2-Year and 10-Year Treasury notes closing the week at 3.57% and 3.73%, respectively. The yield curve continues to “normalize” with the spread between the 2-year and 10-year notes now a positive 16 bp (0.16%). In economic data, headline retail sales rose 0.1% month-over-month, beating expectations for a decline. Consumer spending has been resilient, helping to allay recessionary concerns. Looking ahead to this week, investors will be watching Monday for economic data on the health of the service and manufacturing sectors. Key data will come on Friday with the release of the personal income and outlays. The data includes the Fed’s preferred measure of inflation, the PCE Price index. Headline PCE is expected to fall from 2.5% to 2.3% annualized while the consensus for core PCE is expected to tick up to 2.7% in August, from a 2.6% year-over-year reading the previous month.

Update on the Federal Reserve (from JP Morgan): Last week, the Fed kicked off its much-anticipated easing cycle with a bold move. It cut the policy rate by a jumbo 50bps, surprising many who expected a more regular 25bps cut seen at the start of a soft-landing easing cycle. This move has left investors wondering about the rationale behind it and its implications for markets and the economy. Despite strong economic indicators leading up to the FOMC meeting – including the August retail sales report that beat expectations – the Fed chose to go big. Historically, the Fed has begun its easing cycle with an outsized cut when the economy faced an imminent downturn. Such a downturn is typically characterized by a sharp deterioration in real retail sales momentum, as seen in Jan. '01 and Sep. '07. However, with current sales momentum still solid, the outsized cut was atypical. In its defense, the Fed characterized this move as a “recalibration” of rates, emphasizing it does not set the pace of future cuts. Investors were worried that a 50bps reduction, in the absence of apparent economic concerns, may signal hidden economic weakness. However, Fed Chair Jerome Powell’s repeated reassurances the economy is still strong, and the jumbo cut is aimed to keep it that way, seem to have eased those concerns. While the dot plot suggests future cuts will likely be gradual, investors looking to diversify out of cash will find their window of opportunity shortened by this cut.

Sources: JP Morgan Asset Management, Goldman Sachs Asset Management, Barron’s, Bloomberg, Factset, CNBC.

This communication is for informational purposes only. It is not intended as investment advice or an offer or solicitation for the purchase or sale of any financial instrument.

Indices are unmanaged, represent past performance, do not incur fees or expenses, and cannot be invested into directly. Past performance is no guarantee of future results.